Shareholder Return

Basic Policy on Profit Distribution to Shareholders

- In the face of unpredictable global circumstances and an uncertain business environment, EIZO views continued active investment in R&D as essential to supporting medium- to long-term growth. It is committed to achieving sustainable growth through business expansion and performance improvement, while maintaining financial stability and prioritizing Shareholder Returns as a key management objective.

- The target level for Shareholder Returns (Total Return Ratio) is set at 70% or more of consolidated Net Income for the fiscal year. To contribute to the long-term enhancement of shareholder value and considering EIZO’s financial foundation and the status of Growth Capital, the annual dividend per share will be set at a minimum of JPY105 (fiscal year ending March 2025).

- EIZO may consider a flexible share buyback based on a comprehensive evaluation of its performance, stock price levels, and market conditions.

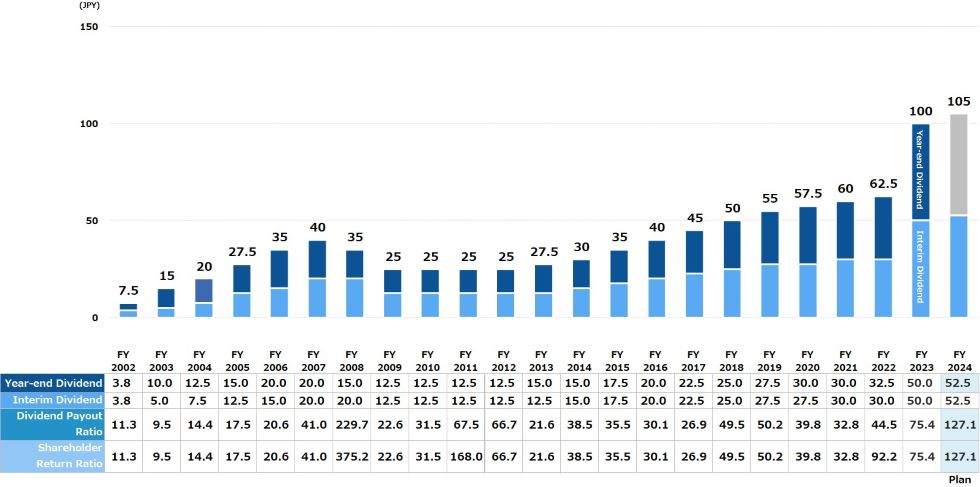

Dividend Payments

- * 22F : The Shareholder Return Ratio includes a share repurchase to the amount of JPY2.8B.

- * The Company has implemented a two-for-one share split effective October 1, 2024. The dividend per share in table has been adjusted retroactively considering the split.